Do you scour the internet for 'case study coke versus pepsi 2001 eva wacc'? Here you can find questions and answers about the issue.

Table of contents

- Case study coke versus pepsi 2001 eva wacc in 2021

- Coca cola vs pepsi

- Does coke own pepsi

- Case study coke versus pepsi 2001 eva wacc 04

- Case study coke versus pepsi 2001 eva wacc 05

- Case study coke versus pepsi 2001 eva wacc 06

- Case study coke versus pepsi 2001 eva wacc 07

- Case study coke versus pepsi 2001 eva wacc 08

Case study coke versus pepsi 2001 eva wacc in 2021

This image demonstrates case study coke versus pepsi 2001 eva wacc.

This image demonstrates case study coke versus pepsi 2001 eva wacc.

Coca cola vs pepsi

This picture representes Coca cola vs pepsi.

This picture representes Coca cola vs pepsi.

Does coke own pepsi

This picture illustrates Does coke own pepsi.

This picture illustrates Does coke own pepsi.

Case study coke versus pepsi 2001 eva wacc 04

This picture shows Case study coke versus pepsi 2001 eva wacc 04.

This picture shows Case study coke versus pepsi 2001 eva wacc 04.

Case study coke versus pepsi 2001 eva wacc 05

This image illustrates Case study coke versus pepsi 2001 eva wacc 05.

This image illustrates Case study coke versus pepsi 2001 eva wacc 05.

Case study coke versus pepsi 2001 eva wacc 06

This image illustrates Case study coke versus pepsi 2001 eva wacc 06.

This image illustrates Case study coke versus pepsi 2001 eva wacc 06.

Case study coke versus pepsi 2001 eva wacc 07

This picture representes Case study coke versus pepsi 2001 eva wacc 07.

This picture representes Case study coke versus pepsi 2001 eva wacc 07.

Case study coke versus pepsi 2001 eva wacc 08

This image illustrates Case study coke versus pepsi 2001 eva wacc 08.

This image illustrates Case study coke versus pepsi 2001 eva wacc 08.

When did the Pepsi and Coca Cola merger happen?

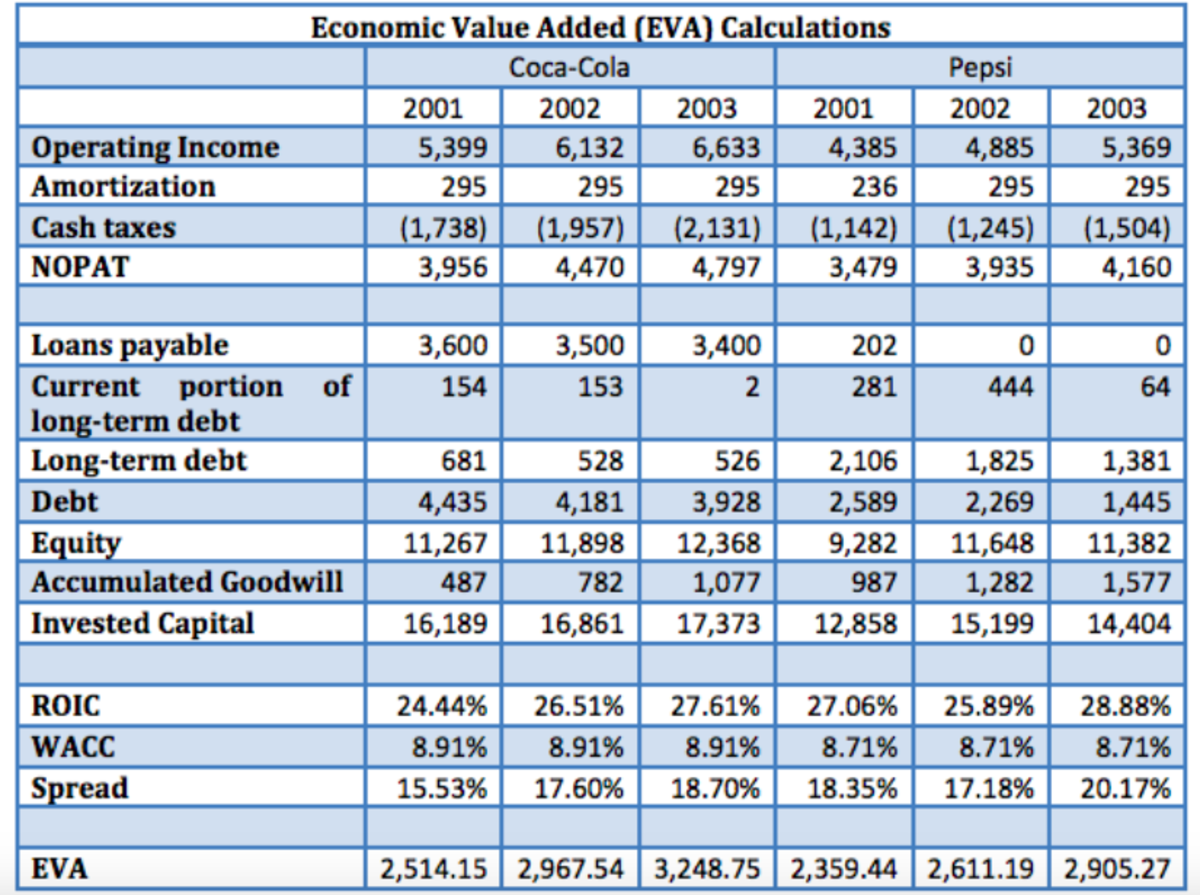

Set in December 2000, immediately following the merger announcement between PepsiCo Inc. and the Quaker Oats Company, this case seeks to examine the implications of the merger for the rivalry between Coca-Cola Co. and PepsiCo, and for value creation by each firm.

Who is the author of Coke vs Pepsi?

Lee is a Masters in Management graduate who has been working as a freelance writer and researcher since 2009.

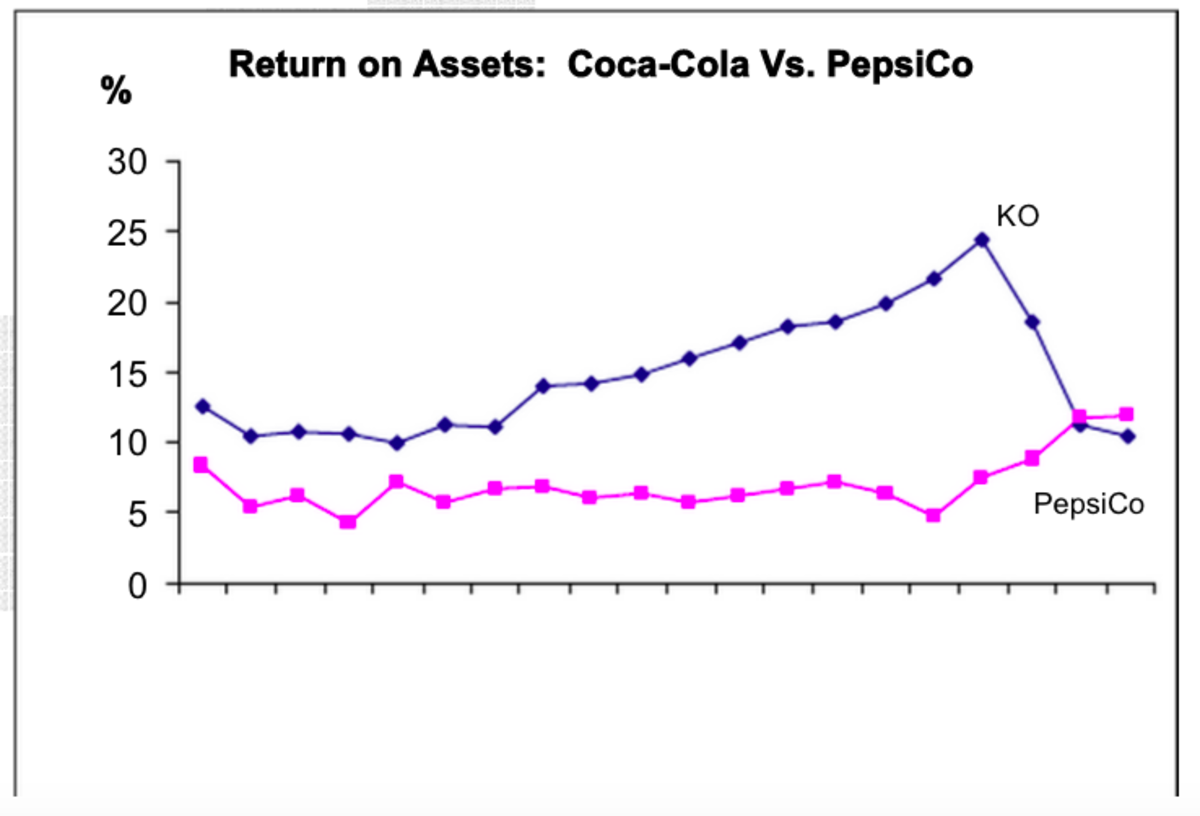

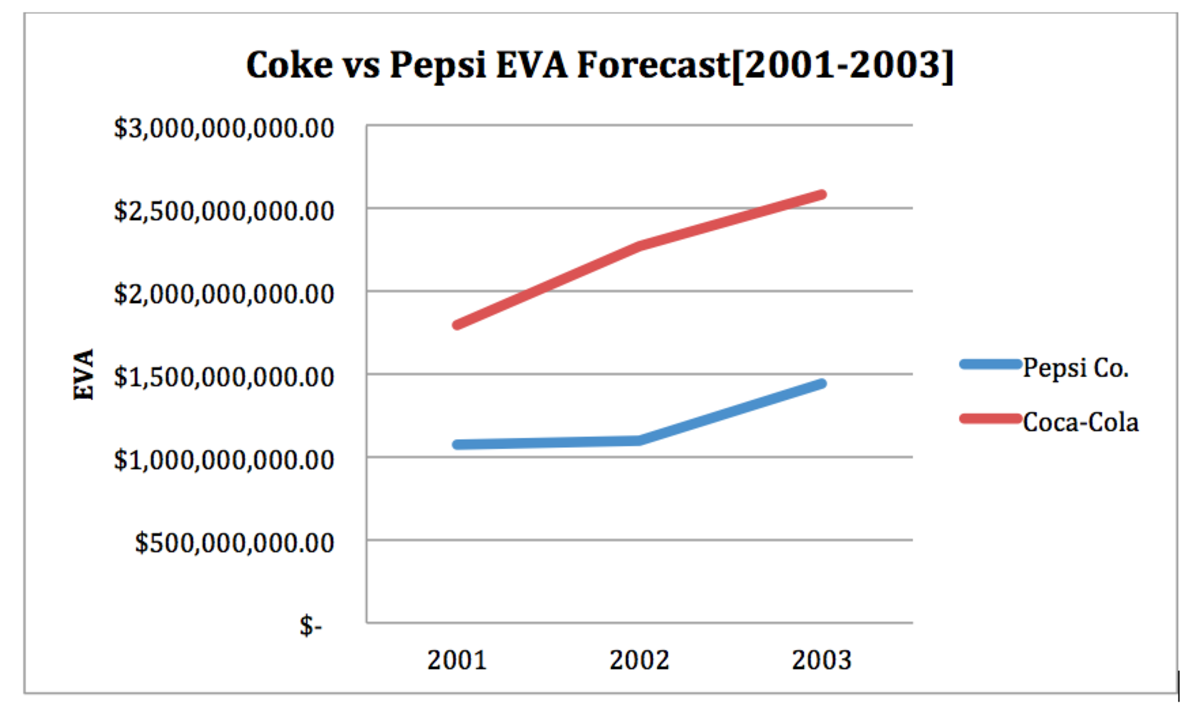

Why does Coca Cola have a higher Eva than Pepsi?

Appendix 2 shows that the forecast data on the Economic Value Added (EVA) on Coca-Cola is consistently higher than Pepsi Co. Once again, this can be due to Coca-Cola’s ROIC, which is higher than Pepsi Co.’s and thus further strengthens the argument that ROIC is the key driver of EVA.

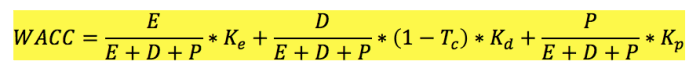

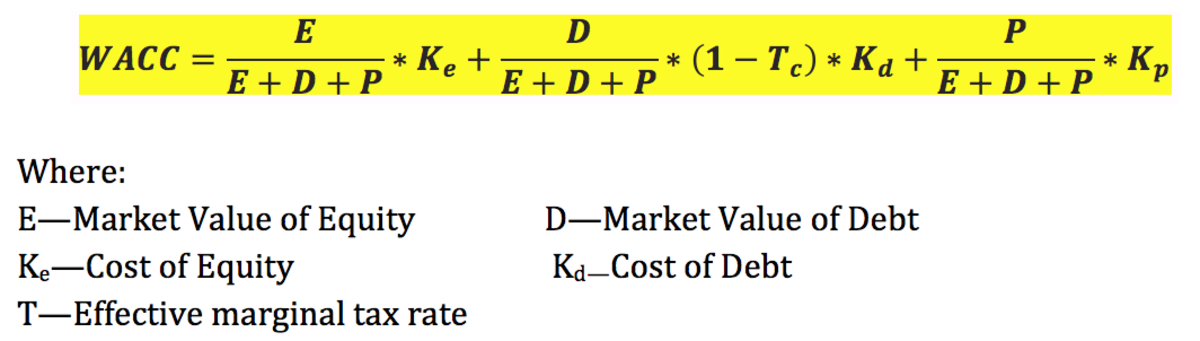

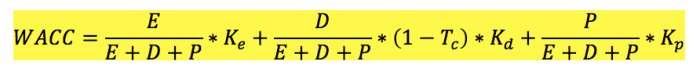

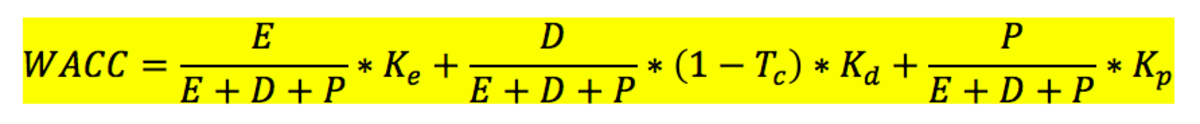

How is the WACC calculated for Coke and Pepsi?

The following were calculated to get the WACC for Pepsi Co. and Coke: Since both Coca-Cola and Pepsi Co. have publicly traded debt, we believe that the most appropriate approach is to calculate the yield to maturity on this debt, which can then be used as a measure for cost of debt.

Last Update: Oct 2021